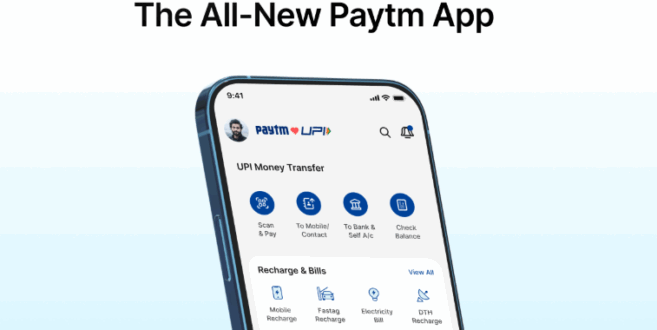

Paytm Launches Smarter App with AI and Clean Design for Everyday Payments

Paytm has launched an all-new version of its app, built around simplicity, intelligence, and speed. The refreshed design introduces a cleaner interface and several AI-powered innovations that make everyday payments easier and more personalized for users.

The new app also rewards every payment with Gold Coins, redeemable as digital gold, turning regular transactions into long-term savings.

AI at the Core of the New Experience

With the latest update, Paytm has shifted to an AI-first approach that learns from user spending habits. The Total Balance feature shows how much money users have across all linked UPI bank accounts in one glance.

AI tags automatically categorize expenses under shopping, bills, travel, or utilities, giving users an instant monthly spending summary. Paytm’s new Payment Search also allows users to look up past transactions by name, note, or type of payment.

Simpler, Faster, and More Private

The new interface makes every interaction seamless. Features like Hide Payments let users maintain privacy by keeping certain transactions invisible from their history.

Users can also download detailed UPI Statements in Excel or PDF formats, complete with payment locations and timestamps—useful for budgeting and tax filing.

Smarter Tools for Everyday Use

The update brings unique features designed for everyday convenience. Magic Paste detects bank details automatically when pasted from WhatsApp messages, saving users time. Favourite Contacts allow one-tap repeat payments, while Payment Reminders ensure timely bill and salary transfers.

Paytm also introduced a Built-in Calculator within the payment flow, letting users quickly calculate totals before paying. Professionals can use the Receive Money widget to place their UPI QR on the homescreen, receiving payments instantly without opening the app.

Cinematic QR Experience and Personalized UPI IDs

The new Cinematic QR scanner lights up, zooms, and transitions smoothly when detecting a QR code, even in low light. Meanwhile, users can now create Personalised UPI IDs like name@ptyes or name@ptaxis, keeping their phone numbers private.

Connecting NRIs to Indian Payments

Paytm now allows Non-Resident Indians (NRIs) from 12 countries to use UPI with their international numbers by linking NRE or NRO accounts. This lets them pay directly in INR while avoiding forex conversion delays.

Redefining Everyday Payments in India

By combining design, intelligence, and trust, the new Paytm app sets a new standard in India’s digital payments ecosystem. It makes managing money smarter, faster, and more engaging for millions of users every day.