Thailand is moving aggressively to carve out a bigger slice of the global semiconductor market, unveiling plans to draft a strategic roadmap within the next 90 days. This move comes as U.S. President Donald Trump reignites his trade war with China, creating fresh opportunities for nations looking to attract tech investments.

The country’s national semiconductor board is set to bring in a consultancy firm to help develop the blueprint, said Narit Therdsteerasukdi, secretary-general of the Thailand Board of Investment (BOI). Additionally, Narit plans to embark on investment roadshows to the United States and Japan to lure semiconductor manufacturers into the region.

A Global Industry in Turmoil

The semiconductor industry has been rattled in recent years by the intensifying U.S.-China rivalry, with Washington enforcing strict controls on chip exports to Beijing. The competition for tech dominance has triggered a massive shift in global supply chains, forcing companies to seek alternative production hubs.

Trump’s latest salvo—a 10% tariff on Chinese imports—has further unsettled markets, making Southeast Asia an attractive alternative for manufacturers looking to sidestep mounting tensions. Thailand, as Southeast Asia’s second-largest economy, is seizing the moment to position itself as a neutral and stable investment destination.

Thailand’s Big Semiconductor Bet

Thailand is already reaping the benefits of the geopolitical turbulence. In 2023, the nation recorded a decade-high 1.14 trillion baht ($33.5 billion) in inbound investment applications, a 35% surge from the previous year. Narit expects this momentum to continue, driven largely by the electronics and digital sectors.

According to a 2024 analysis by consulting firm A.T. Kearney, Thailand ranks second behind India among emerging economies with strong potential for semiconductor manufacturing. The government is now aiming for 500 billion baht in new semiconductor investments by 2029, with a focus on power electronics—a critical component in electric vehicles, data centers, and energy storage systems.

“We think that this is our strength,” Narit said, highlighting Thailand’s ambition to become a key player in the next wave of semiconductor innovation.

Attracting Industry Heavyweights

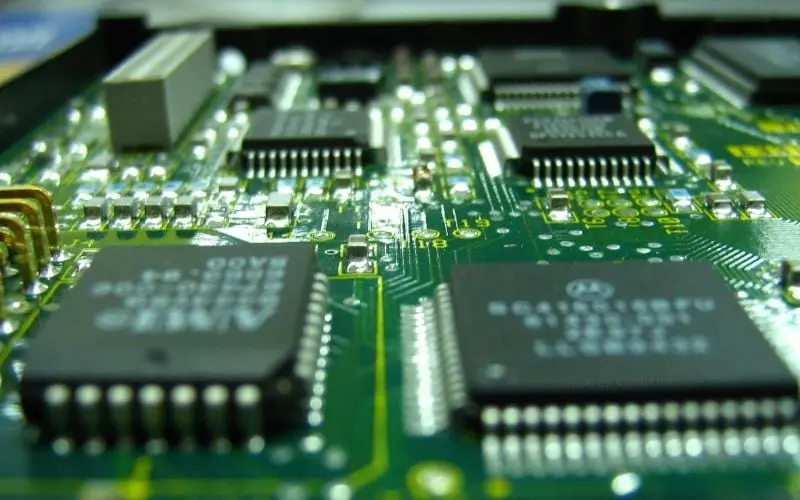

Thailand has already attracted several big names in the semiconductor space. U.S.-based Analog Devices, Japan’s Sony and Toshiba, Germany’s Infineon, and Taiwan’s Foxsemicon Integrated Technology have all set up or expanded their operations in the country. Investment in printed circuit board manufacturing—essential for everything from smartphones to EVs—has also surged since 2023.

“The main reason is the trade war,” Narit admitted. “One of the reasons investors choose Thailand is our position as a neutral country.”

Rivalry with Malaysia

However, Thailand faces stiff competition from Malaysia, which accounts for 13% of global chip testing and packaging and is targeting over $100 billion in semiconductor investments. With the race for semiconductor dominance intensifying, Thailand will need to act swiftly to cement its place as a premier destination for chipmakers.

With the U.S.-China trade war escalating, the stakes have never been higher. But for Thailand, the upheaval presents an opportunity to emerge as a key semiconductor powerhouse in the years ahead.